|

|

|

|

|

|

|

|

|

|||

|

|

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

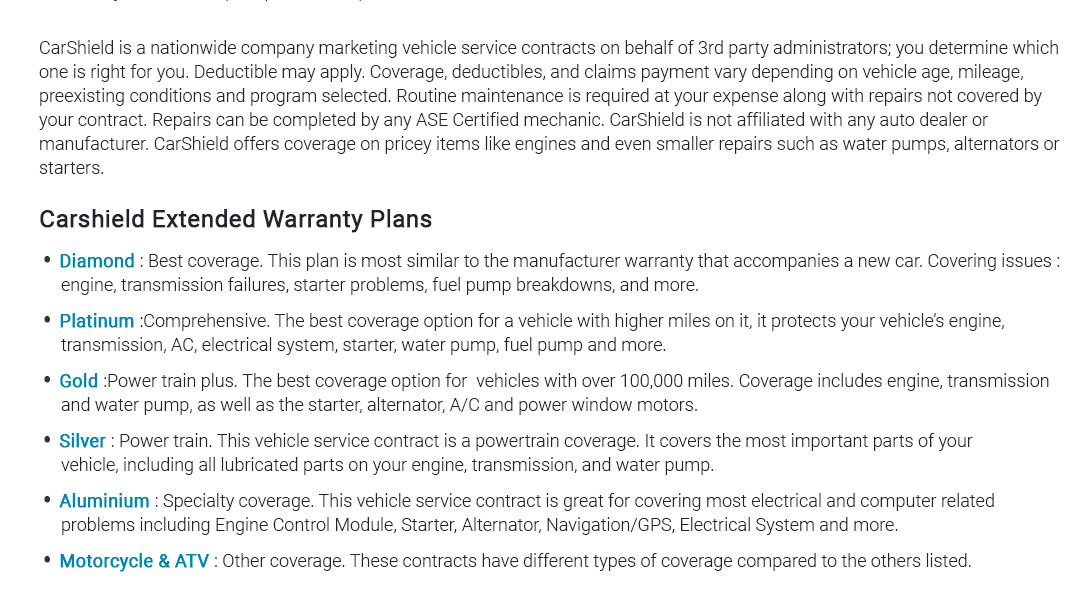

car repair insurance average cost explained for cautious driversSticker shock from a sudden transmission or hybrid inverter can derail a budget. Knowing the average cost of car repair insurance helps you gauge risk and decide if transferring it is worth the price. What drives the number

The averages - keep them groundedMany drivers see $300 - $900 per year for mechanical breakdown insurance added to auto policies. Multi-year service contracts often run $1,200 - $3,500 total. Deductibles typically sit at $50 - $200 per visit. These are reference points, not promises; your quote can land outside this band. Temper expectationsNot every failure qualifies. Wear items, fluids, diagnostics, and taxes may be excluded. Some plans require prior authorization, impose claim caps, or have waiting periods. Savings are real sometimes, but not guaranteed. Selection with long-term impact

Real moment: at 72,000 miles, a water pump quote hit $1,150. A plan with a $100 deductible paid $730 after an internal cap and non-covered taxes - helpful, yet the prior year's $420 premium narrowed the win. Who might skip or delayLow-mileage cars still under powertrain warranty, or drivers with a solid repair fund, may self-insure. Quick rule of thumbIf projected repairs are less than premiums plus deductibles and hassle, skip. For out-of-warranty turbo, luxury, or certain EV components, a well-priced plan can cap downside risk.

|